The financial sector shot up since president election. Although recently there is some pull back within financial sector, the insurance companies hold up much better. One of them is Metlife (MET). Its earning comes up on 2/2/2017. Here I am discussing the possible earnings play and the long term play on Metlife's stock. First let's look at its daily chart. The bollingar band width is extremely narrow, Since last June, we have not seen this narrow band. The coming 2/2/2017 earning will trigger a big move. Although the narrow BB's causal big move has no direction indication, based on current fundamental positives for financial sector, I believe the big move is biased to be up.

Second, let's look at the monthly chart. The long term multiple year's resistance around 56.6~57.5 is inches away from current price: $54.33. The stock price runs in a big ascending triangle. All the monthly MAs underneath act as big and strong support. The break out is just matter of time.

Now, let's see how to invest in long term or play short term earning. Can this earning really make the break out happen? Nobody really knows. If the bets are not expensive, earning play always can play at small odds and small cost with big pay out. Following is the plan:

- long 2/17/2017 57.5 call with $0.41/contract(1/20/2017 market close quote). The Implied volatility (IV) of 2/17/2017 $57.5 call is only 24.18%. The very low IV means that nobody really expect that big move with post-earning move. Will the price surprise everyone after ER? Wait and see.

- long 2/17/2017 57.5~60 call spread with $0.27/contract premium. This will lower the cost substantially. If I bet $300, the potential gain could be $2000 if price close above $60 after 2/17//2017 close. Although the odds is very low, but the pay out is very high(around 6 folds). It may be worth to try.

- The long term play, the break out is just matter of time. The upside target is at least around $65~$70. Long leaps call June/2017 $40 call, assume you paid $15/contract, when it hit target $65, you still have around 66% gain.

- Definitely someone who prefer to use sell put to scoop up the share want to sell 2/17/2017 50 put, however, the IV is so low(only $0.38/contract premium), sell side is not good choice.

In summary, an investor should look at long term strategy; a market player can take a look at short term earning play.

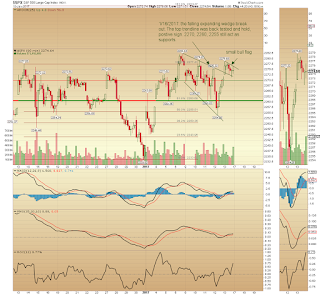

One more pick is CREE: a very volatile earning play. The daily chart showed again a BB extreme contraction pattern just before ER. The big move mostly will be triggered by ER. Last 2 ERs CREE both made $4 down move, if history repeat , I believe the $4 move for this ER too. CREE ER date is 1/24. The 1/27 $28 straddle now only worth $2.5/contract by last Friday's close. So next Monday (1/23/2017) if the straddle trade still can get $2.5~2.7$/contract, it is worth to try. Even post-ER cree made less than $4 move, this straddle trade still have very high probability to make break even.

http://schrts.co/6EmLiG

Another pick is AKS Steel holdings (AKS). Its earning date is before 1/24/2017 open. So if we want to make a ER trade, we better make a trade on 1/23/2017. Let's take a look the monthly chart of AKS. The long term resistance (15 year's resiatnce from 2012 to now) is around 11.3, the current price at $9.52 which is not far away from the resistance line. Some characters are listed below:

- there are certain traders like to place the call option right on the break out level. Why?

- it is cheap OTM option (worth to bet)

- when price break out, it run away fast, pay out ratio high

2. The daily chart BB is ready to expand with earning. Although there is no clear direction indication, my experience tells me the BB expansion usually follow a pre-ER run down. (it happens on amazon, google etc big momentum stocks too) . I c all it deceitful run, the stock price runs down to lower BB, then reverse back up to expand upper BB.

The trade idea is buy March 17, 2017 $11 call, right now only $0.45/contract, if AKS price shoot up after ER, the post-ER drift will help the stock price break out $11.3 level to go much higher, potentially to $15.

Always, remember the option buying risk. If you do not understand the risk, please no follow the trade.